Hydrogen is set to play a key role in the energy transition due to its chemical and physical characteristics, which are significantly different from most common hydrocarbon fuel gases, such as natural gas and propane.

The risks associated with hydrogen use are closely related to its characteristics, and it is necessary to evaluate them carefully when designing, constructing, and operating plants.

In terms of fire and explosion hazards, hydrogen’s most distinctive characteristic is its flammability range, which is very wide, within 4 percent (LFL) and 75 percent (UFL), as well as its very low Minimum Ignition Energy (MIE) of 0.017 milliJoule. These two characteristics combined mean that hydrogen can easily ignite upon release.

At atmospheric pressure and ambient temperature hydrogen is gaseous with a very low density (0.0838 kg/m3), about 14 times lower than air. The low density of hydrogen results in high buoyancy (the tendency to disperse rapidly upwards) that can be an advantage in terms of safety, since in case of release hydrogen disperses upward and dilutes in air, reaching concentrations below the LFL in a short time.

The low density of hydrogen means, however, that it is necessary to compress it to a high pressure (up to 700-1000 bar) to reduce its volume and to be able to handle it within reasonable volumes, and there are safety issues related to the use of pressurized equipment (PED).

When burning, hydrogen flame emits low levels of radiation in the infrared range (no heat is perceived by people), and most of the radiation is emitted in the ultraviolet range. As a result, it is poorly visible to the naked eye, especially in daytime.

The design of plants and layout is crucial: attention must be given to the context, and it is recommended to proceed with a Quantitative Risk Analysis (QRA) to identify credible accident scenarios and assess the consequences.

Since concrete applications for green hydrogen plants are still limited, risk perception associated with this type of plant is limited. It is crucial not to underestimate the risks, and to rely on the applicable technical standards.

RINA has invested a lot in studying the safety of hydrogen, which is demonstrated by a recent collaboration. In 2022, RINA and the Dipartimento dei Vigili del fuoco del Soccorso pubblico e della Difesa civile signed a memorandum of understanding (MoU) with the aim of carrying out studies and research into the field of energy transition and safety.

The agreement provides for initiatives related to the interchange of technical information and experience in the field of fire and explosion risk assessment, as well as the formation of study and research groups, thus enabling RINA and Vigili del Fuoco to enhance each other’s expertise.

Within this framework, in 2022 RINA participated as an external expert in the Working Group that led to the publication of the important Ministerial Decree of July 7, 2023, “Technical rule of fire prevention for the identification of risk analysis methodologies and fire safety measures for the design, construction and operation of hydrogen production plants by electrolysis and related storage systems.”

* RINA Services S.p.A. is accredited by ACCREDIA for the certification of biofuels and bioliquids, according to the national scheme established by Decree 14.11. 2019 and is recognised, respectively by ISCC System GmbH and by 2BS Consortium, for the certification of biofuels, bioliquids, biomass fuels for uses other than transport, advanced biofuels, biofuels with low ILUC risk, renewable fuels of non-biological origin for transport, known as RFNBO* and fuels from recycled carbon, known as RCF*, according to the voluntary schemes approved by the European Community according to the RED 2 Directive (Directive 2001/2018/EC) ISCC EU and 2BS. (*for RFNBO and RCF, recognition of the schemes by the European Community is pending). RINA Services S.p.A. is also recognised by ISCC System GmbH for the certification of sustainable aviation fuels, known as SAF, according to the ISCC CORSIA scheme, one of the schemes approved by ICAO (International Civil Aviation Organization) for certification according to the sustainability criteria defined by CORSIA.

In July 2023, the International Maritime Organization (IMO) revised its initial 2018 greenhouse gas emissions reduction strategy and set a new net zero target of 2050 for shipping.

In parallel, the “Fit for 55” package, a comprehensive set of directives designed by the European Parliament, will ensure Europe becomes the first climate neutral continent by 2050.

This new era for shipping will require companies to closely monitor their fleets in order to meet progressively more stringent emission requirements, while avoiding pollution penalties.

Each shipping company will be required to adopt a ‘techno-economic’ strategy that is appropriate for its individual business model and fleet operating profile, and the use of alternative fuels and advanced technologies will play a leading role going forward.

In the shipping industry, nuclear solutions are now being viewed with increasing interest as a potential means of meeting decarbonization goals.

Although nuclear installations have existed onboard ship for several decades both in the naval fleet and on ice breaking vessels, its application in the merchant fleet has been restricted by a range of factors, including public opinion, cost, technical operation, port management, and contractual compliance.

However, a new generation of small and modular nuclear reactors is paving the way for potential new energy solutions for merchant shipping, particularly for those ships which have a significant power demand and long sailing periods.

The new generation of nuclear power offers promising benefits: a substantial reduction in emissions, a significant increase in the refueling timespan, higher safety standards, and reduced waste compared with traditional nuclear reactors.

Because of their size and modularity, it may be possible to build these new reactors almost entirely in a controlled facility and then installed module by module in the ship’s engine room. This would replace the traditional method of building the reactor onboard ship while under construction in the shipyard.

Due to their flexibility, nuclear reactors can play an important complementary role, supporting alternative fuels and battery technology. In some cases, they can act as a catalyst in the Power-to-X industry, enabling the growth of new fuel infrastructures.

For instance, onshore or floating electrolyzer facilities powered by nuclear reactors could produce hydrogen, methanol, or ammonia, without emissions. Meanwhile, floating nuclear power sources could directly recharge batteries or provide energy to onshore power supply infrastructures in ports.

In this potential scenario, a ship powered by a nuclear reactor could itself become the power source, transferring electric energy to the port.

The potential adoption of nuclear solutions in the shipping industry will inevitably have regulatory implications, requiring an update to the current framework.

The nuclear ship chapter contained in the SOLAS (Safety of Life at Sea) Convention and Code of Safety for Nuclear Merchant Ships can be used as a starting reference point. However, a process of updating will be necessary to effectively regulate nuclear installations onboard marine units, requiring multilateral coordination among flag states, port states and coastal states.

In 2022, RINA Consulting was commissioned by CETUD (the Executive Council of Urban Transport of Dakar) to study the technical, economic and financial feasibility of a biofuel conversion chain to supply Dakar’s bus fleet using local vegetable, animal and household residues.

RINA conducted a multi-criteria analysis of the different potentially exploitable biofuel chains in Senegal, and proposed recommendations on the final choice based on project diagnosis and benchmarking. The study also assessed the feasibility of such production, with an identification of the entire supply chain up to final user.

After the diagnostic phase, attention was focused on the Municipal Solid Waste (MSW) to biomethane chain, considered the most promising for urban transport use in Senegal and in particular in the Dakar metropolitan area.

Indeed, the anaerobic digestion process of these wastes and the valorization of biogas into biomethane offers obvious advantages by exploiting widely available materials that are generally directed to landfills.

Furthermore, the method promotes a virtuous recovery of dangerous and polluting materials, with the additional benefit of reducing CO2 and GHG emissions over the life cycle. By making available by-products (digestate) which can in turn be resold and reused, the method contributes to the creation of an economy circular (residues > biofuel > fertilizer > agricultural raw materials > residues).

Wastewater and food industry waste can also be used in these proposed production units without modification. While they are not a necessary addition, they could be added to the raw materials in the production units, were they to become more readily available in the coming years.

Given that the technology needed for Municipal Solid Waste (MSW) to biomethane production is largely proven and carries few technical uncertainties, it was not considered necessary to consider a small-scale pilot installation.

On the contrary, the direct construction of an industrial-sized facility was considered suitable for the pilot plant, using three development phases:

- An initial pilot plant for 365 m³/h biofuel production for 127 buses, requiring a raw material quantity of 22 thousand tons per year of MSW;

- An expansion of this production site to service a total of 381 buses, requiring two additional plants of the same size on the same site;

- A second full-size production site needing more than 110 thousand tons per year of MSW, enabling the operation of another 635 biomethane buses.

Based on the implementation of these three phases, total production of biomethane could reach approximately 24 million m³ per year. This capacity could potentially power the entire fleet included in the CETUD project for the Dakar bus network.

The energy transition is a complex and challenging process that will require significant investment. The European Union (EU) is committed to supporting this transition, and has a number of funding programmes in place to help businesses, governments, and other organisations invest in clean energy and decarbonisation technologies.

These programmes include (non-exhaustive): Horizon Europe, dedicated to research and innovation, with a budget of €95.5 billion, covering the period 2021-2027; LIFE Programme, entirely focused on environmental, climate, and energy objectives, with a total financial envelope of €5.43 billion within the period 2021 - 2027; Innovation Fund, dedicated to the demonstration of innovative low-carbon technologies. The budget is linked to EU-ETS (Emission Trading System) and may amount to €40 billion from 2020 to 2030; Modernisation Fund, supporting the moderinisation of energy systems and improvement of energy efficiency in 13 lower-income Member States. The total revenues amount to €57 billion from 2021 to 2030, assuming a carbon price of €75/tCO2; Just Transition Fund, supporting the areas most affected by the transition towards climate neutrality and for preventing an increase in regional disparities, with a total budget of €19.32 billion from 2021 to 2027.

There are also smaller funds such as the European Regional Development Fund (ERDF), European Social Fund Plus (ESF+), Cohesion Fund, European Agricultural Fund for Rural Development (EAFRD) and the European Maritime and Fisheries Fund (EMFF).

In addition to EU funding programmes, there are also several national schemes available in Europe to support the energy transition. These vary from country to country, but they typically cover a wide range of areas, including renewable energy, energy efficiency, smart grids, clean transport, and carbon capture & storage (CCS).

The funding programmes help to:

- bridge the funding gap. This is especially important in developing countries and regions, where the cost of clean energy technologies may be prohibitive.

- de-risk investments in clean-tech. This is important because clean energy technologies are often new and unfamiliar, and investors may be hesitant to invest in them without financial support from the government.

- scale up investments in clean-tech. By providing financial support to a large number of projects, EU funding instruments can help to drive down the cost of clean energy technologies and make them more competitive.

It is important to underline that applying to EU and national funding programmes requires the integration of different skills and competences, including:

- Strategic planning skill to create specific business strategies and models in regard to the company’s overall long- term goals aligned to the funding programme objectives.

- Technical skills to assess project feasibility from a technical point of view.

- Financial skills to assess project feasibility from a financial point of view.

- Environmental impact assessment competences to assess the project impact on reducing greenhouse gas (GHG) emissions and climate change. For instance, “Do No Significant Harm (DNSH) assessment” is required in all tenders by the Italian Recovery and Resilience Plan (PNRR).

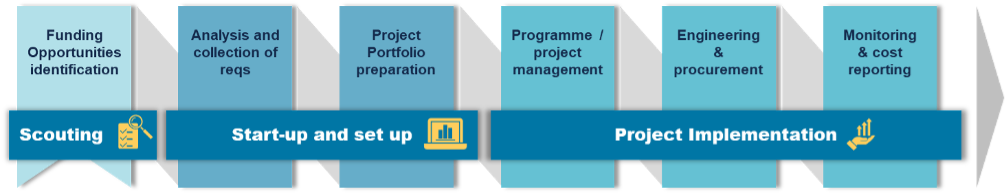

RINA provides comprehensive support in the preparation and submission of applications for the main EU and national funding programmes.

If funding is granted, RINA can also contribute to the subsequent implementation of projects using its specialist technical-engineering and economic-financial skills.